The importance of safeguarding property in the context of divorce proceedings is of paramount importance.

Divorce is often a difficult and emotionally charged process that involves the division of property acquired during the marital union.

It is essential to ensure the preservation of these assets in order to ensure equitable distribution and to preserve the financial balance of the parties, especially when the heritage stakes are high.

Understanding the issues related to asset protection is essential to secure one’s financial future and limit possible losses.

Here, we will discuss the various aspects of this protection, from various angles and providing relevant advice, in order to equip you to make wise decisions.

- Understand the importance of protecting assets in divorce proceedings. 3

- What is a simple trust and how does it work in the event of a divorce?. 5

- Benefits of using a simple trust for asset protection in the event of divorce. 6

- Considerations when establishing a simple trust for divorce proceedings. 7

- Explore the role of a trustee in a simple asset protection trust. 8

- Misconceptions and myths about simple trusts in divorce cases. 9

-

Real-world examples of successful asset protection with bare trusts. -

Alternatives to simple trusts for the protection of assets in divorce proceedings. -

Develop the knowledge to protect your assets in the event of a divorce.

Exposure of assets to risk during a separation: When the marital bond is broken, the question of the distribution of property can give rise to lively debates.

Without adequate protection, patrimonial assets, such as residences, investment portfolios, or businesses, built up during the marriage, may be at risk of disputed division or total loss.

It is essential to be aware of this vulnerability and to act preventively to safeguard these assets. Legal context and available alternatives: The legal framework surrounding divorces varies from jurisdiction to jurisdiction, making knowledge of local laws on the division of property essential.

The assistance of a lawyer specialising in matrimonial law is recommended; The latter will accompany you throughout the process and enlighten you on the different options available to you. These include prenuptial or postnuptial agreements, as well as the creation of trusts or the use of other legal devices for the preservation of property.The essentials of asset protection in a divorce situation Safeguarding property during divorce proceedings is crucial to ensure a fair distribution and preserve the financial security of the parties involved.

It is essential to prevent any loss of assets in a context where the financial stakes are often considerable.

This section will highlight asset protection strategies, offering diverse perspectives and relevant information to guide sound decisions.

- The vulnerability of assets in the event of a marital breakdown: The dissolution of a marriage frequently jeopardizes the joint patrimony.

In the absence of safeguard measures, accumulated assets, whether real estate, financial investments or companies, may be subject to disputed division or even total loss.

It is essential to be aware of this vulnerability and to act accordingly to protect these assets. - Legal framework and available options : The legal framework for divorce varies by jurisdiction, making it imperative to understand local laws.

The accompaniment of a lawyer specializing in matrimonial law is recommended to navigate the process and examine all possible solutions, such as prenuptial or postnuptial agreements, trusts and other legal property protection devices. - The contribution of simple trusts in safeguarding assets: Setting up a simple trust is an effective method of protecting property during a divorce.

This legal arrangement allows a trustee to hold legal title to assets without having control or beneficial interest in them.

In the context of a separation, the simple trust can be used to exclude property from the marital patrimony, thus exempting it from division. - Advantages of simple trusts: – Distinction of property: the simple trust makes it possible to isolate the assets of the common patrimony, preventing their division during divorce.

– Protection of the inheritance: For current or future inheritances, the simple trust offers a barrier against their consideration as marital property and their eventual division with the spouse.

– Control and flexibility: Although legal ownership is transferred to the trustee, you can keep control of the assets as the beneficiary, ensuring their proper management and growth.

- Evaluation of alternative options: Although so-called “bare” trusts can have significant advantages, other asset safeguard mechanisms should be taken into account.

Among these, prenuptial or postnuptial agreements stand out, defining the distribution of property in the event of separation.

Nevertheless, these contracts are not immune to litigation and can be challenged in court.

In contrast to the latter, bare trusts are proving to be significantly more robust and legally reliable instruments for asset preservation. - The preeminent alternative: Faced with the vulnerability of assets in the context of divorces, the implementation of a simple trust emerges as the most judicious protection strategy.

Naked trusts, which allow the segregation of assets, the safeguarding of inheritances and the retention of control over them, are a comprehensive solution for securing your financial future.

However, it is imperative to seek the expertise of a seasoned lawyer in family law and wealth preservation to ensure that this approach is appropriate and legally compliant with your particular situation.

Becoming aware of the importance of protecting assets in the event of a divorce and exploring options such as simple trusts are essential proactive steps to safeguard your hard-earned assets and ensure your long-term financial security.

It is essential to keep in mind that knowledge is power, and professional consultation is a must to successfully navigate the maze of divorce and asset protection.

1. Understand the importance of protecting assets in divorce proceedings

At the heart of Quebec patrimonial law, the trust stands out as a complex and ingenious tool for managing and transferring property.

Rarely grasped in all its subtlety by the general public, this legal structure nevertheless offers undeniable advantages, both in terms of estate planning and tax optimization.

It is attracting the growing interest of professionals and individuals alike in search of sustainable solutions to preserve and grow their wealth.

The trust in Quebec is therefore much more than a simple agreement; It is a legal entity that holds and protects assets for the benefit of one or more designated persons.

Far from being a concept reserved for insiders, it deserves careful exploration… Legal mechanism: A trust is defined as an act by which one person (the settlor) transfers property to another person (the trustee), who holds and administers it for the benefit of a third party (the beneficiary).

This mechanism is based on three essential pillars: transfer of ownership without immediate transfer of possession; the separation of control and enjoyment of property; and the duty of the trustee to act diligently, honestly and loyally. Categories of trusts: There are two main categories of trusts in Quebec: testamentary trusts and inter vivos trusts.

The first begins upon the death of the grantor, in accordance with the instructions set out in the settlor’s will.

The second is created during the settlor’s lifetime by contract or donation.

An inter vivos trust can be revocable or irrevocable.

In the first case, the settlor retains some control over the property and can change or terminate the terms of the trust as he or she sees fit; in the second case, he definitively renounces all power over these goods…

This is an irreversible choice but one that brings with it certain significant tax advantages. As for their purpose, a distinction is generally made between family trusts – intended to protect and pass on family wealth – and commercial trusts – used in particular to manage businesses or isolate certain assets for a specific purpose (e.g., philanthropy, real estate).Practical applications : The practical use of a trust is as diverse as it is varied.

For some, it will ensure efficient and discreet management of family assets; for others, it will be used as a strategic tool in the conduct of business. Tax benefits: One of the major attractions of setting up a trust is its tax implications.

In fact, under certain conditions strictly regulated by the Canada Revenue Agency (CRA) and Revenu Québec, it is possible to make significant tax savings.

In a family context, a trust can be used to preserve the inheritance for future generations while taking into account the specific needs of each beneficiary (e.g. minor children or people with special needs).

It also offers the advantage of preventing inheritance disputes through a clearly defined distribution of assets.

Trust and divorce In the tumult of a divorce, the division of property often turns out to be a source of disagreement and complexity.

One of the possible strategies to safeguard assets is the establishment of a simple trust. This legal arrangement authorises a third party, the trustee, to hold assets on behalf of another party, the beneficiary.

This structure is frequently used to protect assets and ensure that they are fairly distributed during a divorce.

For the beneficiary, the simple trust can represent a bulwark of security and control over his or her property.

By transferring their assets to a trust, they entrust legal ownership to the trustee, who is then legally obliged to act in the best interests of the beneficiary.

This configuration provides a barrier against the risk of mismanagement or squandering of assets during divorce.

On the other hand, the trustee must regard the administration of a bare trust as a charge of great liability.

They are required to fulfill their fiduciary duties and look after the interests of the beneficiary, which includes managing the assets, making sound investment decisions, and making the necessary distributions.

Their role requires impeccable integrity, and any deviation can have serious legal consequences. Benefits and Constraints of a Bare Trust in the Context of a Divorce To understand how a simple trust works in a divorce situation, it is necessary to analyze the advantages and restrictions associated with it: Advantages:

- Preservation of assets: Trusting assets allows them to be removed from division in the event of divorce, thus ensuring their separation and exclusion from the marital patrimony.

- Control and management: The beneficiary retains control of the assets within the trust, giving them the ability to make investment and distribution decisions as needed.

Tax planning through a trust can generate significant benefits, such as tax reductions, income sprinkling, or capital gains valuation strategies. However, there are some constraints to consider:

- Transfer of ownership: The transfer of property to a trust results in the relinquishment of direct ownership of the property, which may limit the beneficiary’s freedom of action to use or assign.

- Trustee’s Choice: The appointment of a trusted manager, responsible for asset management, is essential.

It is imperative to ensure the integrity, financial competence and commitment of the employer to respect his fiduciary duties. - Legal complexities : The establishment and management of a trust involves significant legal aspects that require the intervention of legal and financial specialists.

Beyond the simple trust, it is wise to examine other asset protection mechanisms:

- Prenuptial or postnuptial agreements : These legal provisions specify the distribution of property in the event of separation, thus helping to limit conflicts during divorce proceedings.

- Discretionary trusts: They differ from simple trusts in that the trustee has the latitude in managing the assets, thus offering an alternative for those wishing to maintain a certain control while protecting their wealth.

- Separation of property: This method involves retaining individual ownership of assets, removing the need for complex trust structures.

Determining the best asset preservation strategy in the context of a divorce depends on a variety of factors, including the nature and value of the assets, the degree of control desired and the specific circumstances of the parties involved.

Consultation with legal and financial professionals is essential to ensure that the chosen method is aligned with the intended objectives and provides adequate protection.

A simple trust can be an effective asset protection device during a divorce.

It has advantages, such as wealth protection and tax planning, while also having limitations, particularly with regard to direct loss of ownership and legal complexity.

An evaluation of alternatives and obtaining sound advice is recommended to choose the most suitable strategy for each individual situation.

In the event of divorce, the protection of property is a key concern.

The adoption of a simple trust, a structure where a trusted third party holds the property on behalf of a beneficiary, is an option to consider.

This solution can be beneficial for safeguarding assets during the divorce process, by securing them against possible claims.

We will detail the advantages of using a simple trust in the context of a divorce, approaching the issue from different angles and offering an in-depth perspective.

2. What is a trust and how does it work in the event of a divorce?

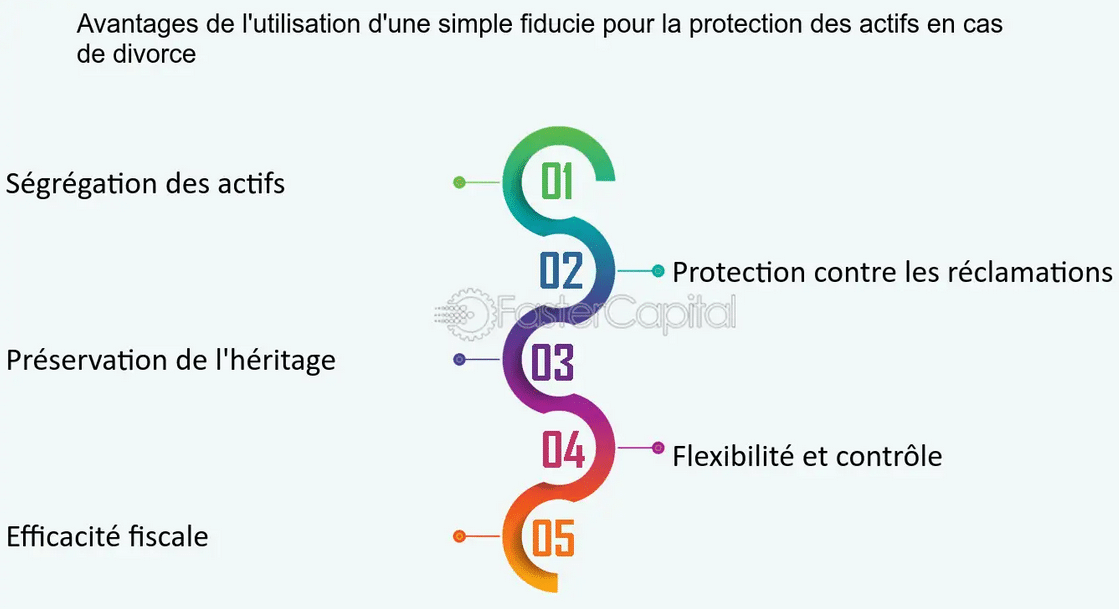

The establishment of a trust, known as a simple trust, offers the essential possibility of distinguishing assets.

By transferring the assets in such a structure, they are held by the fiduciary, which separates them from the private patrimonial sphere of the individual.

This distinction is of particular interest in divorce proceedings, ensuring that the assets of the trust remain separate and secure from the claims of the spouse.

In addition, the protection of assets is enhanced within a simple trust, shielding them from the claims of the separating spouse.

The full enjoyment of the property by the beneficiary precludes its consideration as part of the marital patrimony, thus preventing its division.

This safeguard is crucial for valuable assets, whether they are real estate, investments or participations in companies, thus guaranteeing the retention of control and ownership.

The preservation of the inheritance is another advantage of the simple trust.

Because assets are transferred to it, individuals can ensure that their designated heirs receive them in accordance with their wishes, regardless of any divorce.

This precaution is crucial in the event of fear of claims from the spouse on the inheritance.

The simple trust then becomes an instrument for defending the family patrimony, ensuring its transmission according to the designs of its owner.

Flexibility and control are preeminent features of the simple trust.

The beneficiary has the power to manage and decide on the assets, thus allowing him to decide on the investment directions, the terms of distribution or disposal.

This decision-making power is particularly beneficial in the context of a divorce, as it gives individuals the ability to preserve their property from adverse claims.

As for tax efficiency, simple trusts can be advantageous in the event of a divorce.

The transfer of assets can open the door to tax planning arrangements, including capital gains exemptions or a reduction in inheritance tax.

However, it is essential to consult a tax advisor to assess the tax implications and benefits of using a simple trust within the applicable legal framework.

Compared to other asset protection mechanisms, such as prenuptial agreements or offshore trusts, the simple trust has unique advantages.

While prenuptial agreements can be challenged and may not have the force of law in all jurisdictions, offshore trusts require complex management and can have tax and regulatory consequences.

The simplicity and flexibility of the simple trust often make it a more suitable and effective solution for those looking to protect their assets in the event of a divorce.

Be aware that opting for a simple trust in the context of a divorce can result in significant advantages: the separation of assets, their protection against claims, the preservation of the inheritance, as well as the maintenance of flexibility and control, not to mention the tax advantages.

This approach allows individuals to preserve their assets and secure their financial situation in turbulent times. However, it is advisable to seek the expertise of legal and tax specialists in order to fully understand the issues and the suitability of a simple trust in each particular case.

3. Benefits of Using a Bare Trust for Asset Protection in the Event of Divorce

In the context of a marital separation, safeguarding one’s assets is a major issue.

Among the possible arrangements, the simple trust stands out.

This legal mechanism, where a trustee holds property for the benefit of a third party, can help safeguard assets by separating the beneficial ownership of the property of the individual affected by the divorce.

However, several elements deserve special attention when setting up such a trust in this context.

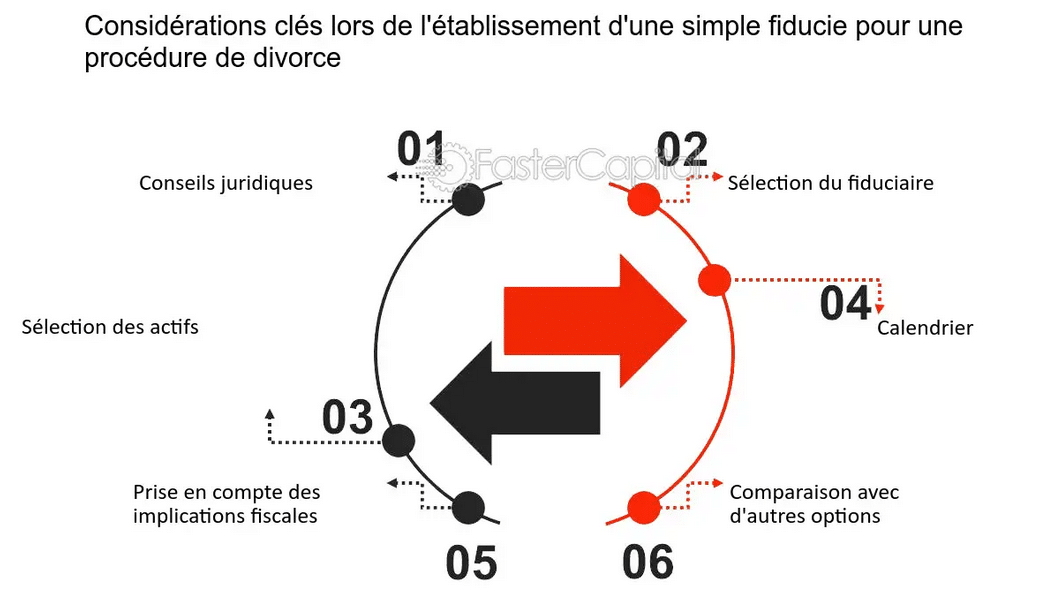

Firstly, consultation with a lawyer is essential.

As each divorce is unique, the application of the simple trust may vary depending on local legislation and the situation.

A lawyer specializing in matrimonial law and wealth protection will be able to provide adequate advice on the proper implementation of the trust.

Second, the choice of trustee is paramount.

The latter will hold legal ownership of the assets and will therefore play a central role in the preservation of assets during the divorce proceedings.

It is recommended to appoint a person who is trustworthy, financially reliable and aware of the responsibilities inherent in this position, whether it is a relative, a friend or a professional.

Third, careful attention should be paid to the assets to be included in the trust.

An assessment of the nature and value of the assets is necessary to determine their eligibility.

Variable-value assets, such as stocks or real estate, may require more planning.

Fourth, timing is critical.

It is generally recommended that the trust be set up in advance of any marital conflict or divorce proceedings.

Late transfers of assets to trusts can be scrutinized by the courts, which can interpret them as attempts to conceal them.

A trust established early will be more likely to be recognized as legitimate.

Fifth, it is essential to consider the tax implications.

The transfer of property to a trust can have tax consequences for both the settlor and the beneficiary.

A consultation with a tax expert is therefore essential to understand the implications and ensure compliance with tax regulations.

Sixth, it is crucial to parallel the simple trust with other asset protection mechanisms available in the event of divorce, such as prenuptial agreements or structures such as joint ventures or limited liability companies, which can offer additional benefits.

Setting up a simple trust requires careful consideration and the support of qualified advisors.

By relying on legal recommendations, choosing a suitable trustee, selecting assets wisely, considering timing, assessing the tax impact, and considering other alternatives, individuals can make informed decisions about establishing a simple trust.

The optimal strategy will depend on the specific characteristics of each divorce, making it essential to assist legal professionals in this complex area.

4. Key Considerations When Establishing a Bare Trust for Divorce Proceedings

In the context of a marital separation, the establishment of a simple trust is a wise solution to preserve one’s wealth.

Such a legal mechanism involves the transfer of legal ownership of the property to a trustee, who holds it for the benefit of the beneficiaries.

This is particularly relevant in the divorce process, where it helps to remove assets from the community of property regime, thus preserving their individual character.

The role of the trustee is central to the simple trust system intended for the protection of assets.

The trustee, who holds the legal title to the property, is entrusted with a trust mission aimed at serving the best interests of the beneficiaries.

He is committed to sound management and informed decision-making regarding the use, investment and distribution of assets.

In the particular context of divorce, the trustee becomes a bulwark, ensuring the separation of the couple’s property and its protection from any distribution.

The duties and responsibilities of the trustee in a simple trust are manifold.

They include a duty of loyalty, a duty of care and an obligation of impartiality.

The trustee must act with integrity and competence in the administration of the property while avoiding any conflict of interest.

In a divorce situation, the spouse must ensure that the assets are not commingled with those of the household and that they are managed in such a way as to preserve their independence.

The wise choice of trustee is essential when establishing a simple trust to protect assets in the context of a divorce.

It is important to appoint an individual who is reliable, qualified and aware of the legal and financial issues involved in managing a trust.

It is common for those concerned to opt for a professional trustee, such as a lawyer or a trust management entity, in order to ensure neutral management that complies with the legal provisions.

The different possibilities for the role of the trustee in a simple trust dedicated to the preservation of property must be weighed against each other.

On the one hand, the appointment of a family member or friend may seem opportune but may lead to conflicts of interest or inappropriate management.

On the other hand, the use of a professional fiduciary with the necessary expertise and experience offers a guarantee of increased security and objectivity.

Professional fiduciaries have the skills to navigate the legal and financial maze with discernment to ensure the protection of assets, thereby strengthening the interests of beneficiaries.

The role of the trustee in a simple trust is crucial to securing assets during divorce proceedings.

An informed selection of the trustee, combined with a thorough understanding of his or her obligations, will allow individuals to effectively protect their assets from incorporation into the marital patrimony. The use of a professional property manager is generally the most relevant approach, guaranteeing expertise, impartiality and serenity in a complex legal context.

5. Exploring the Role of a Trustee in a Simple Asset Protection Trust

Examining the function of a trustee in a simple trust intended to safeguard property during a marital separation reveals misconceptions as well as unfounded beliefs.

- First, it is a mistake to think that simple trusts are exclusively beneficial to individuals with substantial wealth.

Indeed, although these structures can be advantageous for wealthy people, they also serve to preserve the assets of those with more limited means.

A variety of assets can be placed in a simple trust, such as cash, investments, equity or personal property.

A divorcing couple may, for example, opt to create such a trust in order to secure their savings or collective investments, thus removing them from the vagaries of individual finances and limiting the risk of conflict or maladministration during the divorce.

The value of the property, even if limited, does not impair the significant benefits of a simple trust.

A spouse who wishes to bequeath an object of sentimental value can insert it into a trust in order to remove it from the divisible matrimonial property framework.

Confidentiality is another advantage, as assets placed in trust are not disclosed during the divorce proceedings, which is beneficial to those who value their privacy. - Second, the view that simple trusts confer total immunity from the division of property is also false.

Despite a certain degree of protection, it is essential to understand their restrictions and the elements that can influence their effectiveness.

Family courts have the power to scrutinize the use of these trusts and may include them in the marital patrimony if they appear to have been established with the intent to remove property.

It is therefore essential to set up a simple trust with legitimate reasons and to maintain impeccable transparency.

The timing of the creation of the trust is also decisive; A trust established prior to any marital conflict is generally seen as a legitimate safeguard approach.

It should be noted that protection varies from jurisdiction to jurisdiction, making it essential to consult competent legal counsel to assess the impact of such a trust in the specific context of a divorce. - Third, it is inaccurate to believe that simple trusts are the only method of asset protection.

Other options, such as prenuptial or postnuptial agreements, should be considered to assess the best strategy for each particular case.

These agreements can provide a clear definition of how assets will be divided, providing security for both parties.

They are not suitable for everyone, but can prove to be an effective way of preserving assets.

In various jurisdictions, the family courts have the power to investigate and scrutinize the use of simple trusts in divorce proceedings.

When it is established that a simple trust was created for the purpose of removing or concealing property from the spouse, it can be integrated into the matrimonial patrimony subject to division.

It is therefore imperative to establish a simple trust for legitimate reasons and to ensure total transparency during its establishment.

The timing of the creation of a simple trust can influence its efficiency.

A trust set up shortly before or during a divorce can raise doubts and lead to scrutiny.

Conversely, a trust established well in advance of any marital disagreement may be perceived as a legitimate step towards preserving wealth.

It should be noted that the degree of protection afforded by a simple trust is likely to vary depending on the legislation.

The legal provisions governing divorce vary from one country to another, and even between states or provinces within the same country.

It is therefore essential to seek legal advice tailored to the relevant jurisdiction to fully grasp the impact and effectiveness of a simple trust in the specific context of your divorce.

6. Common Misconceptions and Myths About Bare Trusts in Divorce Cases

When it comes to asset protection, it is a mistake to believe that simple trusts are the only solution.

It is essential to evaluate alternative strategies, examine their advantages and limitations in order to choose the best method for your personal situation.

Matrimonial agreements, concluded before or after marriage, can delimit the division of property in the event of separation and provide legal certainty for the spouses.

While they may not be suitable for everyone, they can be an effective way to protect assets and reduce potential conflicts.

Offshore trusts, on the other hand, can be particularly suitable for individuals with substantial assets or a complex financial situation.

Established in jurisdictions where tax and wealth protection legislation is advantageous, they can strengthen confidentiality and the safeguarding of assets in the face of possible claims.

Unlike simple trusts, discretionary trusts give the trustee significant latitude in the management and distribution of assets.

This flexibility can be beneficial in the context of a divorce, allowing the manager to take into account changes in circumstances and the needs of the beneficiaries.

Debunking the misconceptions and myths frequently associated with simple trusts in divorce cases is crucial to making sound decisions about wealth protection.

While simple trusts can be an interest mechanism, they are not always appropriate.

Exploring alternative solutions, consulting legal experts and taking into account the particularities of your situation will guide you towards the most relevant strategy to effectively safeguard your assets.

7. Real-World Examples of Successful Asset Protection with Bare Trusts

Practical cases in the field of heritage preservation prove to be invaluable analytical tools.

They make it possible to grasp the challenges and tangible benefits related to property preservation systems.

Simple trusts, which are often preferred in divorce proceedings, are a perfect illustration of this dynamic.

The examination of situations where these instruments have enabled effective asset protection offers an informed and detailed view of their application.

Take the example of John and Sarah, a wealthy couple from the Laval area, who, fearing that their assets would be squandered upon their divorce, sought the expertise of an advisor.

They chose to establish a simple trust, thus separating ownership from the management of their assets.

This approach prevented their fortune from being considered as a shareable marital asset.

This particular case underscores the relevance of strategic anticipation and the merits of a simple trust as a bulwark against the division of matrimonial property.

In another case, Réjean and Monique, faced with a complex divorce and substantial business assets, considered protecting their shares while seeking to limit the tax impact of the separation of property.

The creation of a simple trust has facilitated the transfer of their business assets while retaining the management of them.

This arrangement not only protected their assets from the repercussions of divorce, but also optimized the tax burden through the separate tax entity that the trust represents.

This case study demonstrates the ability of the simple trust to safeguard assets while maximizing tax benefits.

As for Emma, a successful entrepreneur, she feared that her business would be weakened by her divorce.

She wanted to maintain control over her activities while protecting her property.

The establishment of a simple trust allowed him to transfer ownership of his business while retaining operational control, thus protecting his estate from any claims upon the dissolution of the marriage.

This particular case highlights the flexibility and authority that a simple trust can provide, making it an attractive option for entrepreneurs who want to protect their interests.

However, it is essential to compare simple trusts to other asset preservation mechanisms to make an informed choice.

While prenuptial agreements can provide a degree of predictability by pre-defining the division of property and safeguards, they are not unalterable and can be revoked in court.

Simple trusts, on the other hand, offer a more robust and legally binding structure for safeguarding assets.

These practical cases illustrate the usefulness of simple trusts in preserving assets during a divorce.

Whether it’s to safeguard wealth, optimize tax benefits or keep control of a company’s assets, the simple trust is a versatile solution.

Despite the existence of alternatives such as prenuptial agreements, simple trusts are positioned as a more comprehensive and secure asset protection strategy. Understanding real-world examples and looking at different perspectives allows individuals to make sound decisions to protect their assets in divorce proceedings.

8. Alternatives to Simple Trusts for Asset Protection in Divorce Proceedings

In the context of a marital separation, safeguarding the integrity of one’s property is a primary concern.

It is recognized that the use of simple trusts is a common strategy for the preservation of property.

However, there are alternatives that need to be considered, each with its own unique characteristics and may be beneficial depending on the context.

For example, prenuptial agreements establish, before the union, the terms and conditions for the distribution of property in the event of a breakdown.

These agreements precisely delimit the prerogatives and commitments of the spouses, thus making it possible to preserve certain assets, such as a pre-existing business at the time of the marriage, from any division.

Postnuptial agreements, on the other hand, are developed after the marriage and may be relevant when the need to protect certain property becomes apparent during the union.

For example, they can ensure that an inheritance, received during the marriage, remains a personal asset.

Family trusts are another option, making it possible to distinguish assets from the individual wealth sphere by transferring them to a dedicated structure.

This approach is particularly suitable for individuals with substantial assets or carrying out a risky professional activity, such as a doctor wishing to protect his practice and his assets from any claim in the context of a divorce. The incorporation of a business corporation (INC) can also be a wise strategy to protect assets during a separation in Quebec.

By creating a separate legal entity, it is possible to transfer assets to the corporation, thereby subtracting them from the divisible estate.

This approach can be particularly relevant for rental properties, for example.

Finally, offshore trusts, although they offer a higher degree of protection, are established in jurisdictions with laws favourable to the protection of assets, making it more difficult for creditors, including a divorcing spouse, to access.

Nevertheless, their implementation and management require increased vigilance, particularly in terms of international tax compliance.

Prenuptial and postnuptial agreements are suitable for couples who want to clearly define the management of their assets.

Family trusts are for those with significant wealth or in high-risk occupations.

Incorporations are recommended for the protection of specific assets, while offshore trusts are suitable for safeguarding high-value assets, provided you have expert guidance.

It is essential to note that while simple trusts are frequently preferred for the protection of property in the event of divorce, other mechanisms offer distinct advantages.

A careful assessment of individual circumstances, supported by professional advice, will guide you to the most appropriate choice for asset preservation in this ordeal.

9. Develop the knowledge to protect your assets in the event of a divorce

It is essential to acquire in-depth knowledge to ensure the protection of your assets.

A thorough understanding of the legal aspects and consideration of various strategies will allow you to secure your assets during this delicate period.

It is advisable to familiarise yourself with the legal provisions relating to divorce in your jurisdiction.

Legislation differs and influences the division of assets; Therefore, the assistance of a lawyer specializing in family law is essential.

A good understanding of the laws will help you make wise decisions for the preservation of your assets.

Establishing a prenuptial or postnuptial agreement is a prudent approach.

These agreements delineate the distribution of property in the event of divorce, thus protecting premarital possessions, inheritances or family businesses.

Although the discussion around these contracts may seem unromantic, it is a guarantee of serenity and wealth security in the long term.

The creation of a simple trust is another avenue to explore.

This legal arrangement consists of placing assets under the management of a fiduciary for the benefit of third parties.

In the context of divorce, such a structure can prevent the integration of property into the marital patrimony.

Thus, by transferring valuable assets to a trust, you reduce the risk of having them divided during the divorce.

However, it is essential to recognize the constraints and dangers inherent in a trust.

Some courts may revoke a trust that is deemed fraudulent.

A poorly designed or managed trust can also be called into question.

It is therefore crucial to seek the expertise of a professional to ensure the validity and compliance of the trust.

It’s a good idea to compare different asset protection solutions, such as discretionary or family trusts, which offer more control and adaptability, while preserving assets in the event of a divorce.

It is important to analyze the pros and cons of each option and select the one that best suits your individual needs.

Consultation with a qualified professional is strongly recommended.

A family law lawyer or a financial advisor specializing in divorces will be able to offer you personalized support and guide you through the complexities of protecting your property.

In short, safeguarding your assets during a divorce is essential for your future financial stability.

Through proper preparation, an understanding of the legal framework and consideration of different strategies, you can act proactively.

It is essential to seek professional advice for informed decisions that will safeguard your assets for the long term.